by John Sandy

Retirees in the United States are starting to feel the pinch from high inflation in 2021. Things could get worse in 2022 and beyond.

Policies of the current Congress and the Executive Branch are dragging the dollar down. At the annual rate of inflation, 6.2 % for year ending October 31, and if inflation continues at the same rate in the future, the value of the dollar will be cut in half in about twelve (12) years. In this scenario, a dollar which buys a gallon of milk today will only buy a quart of milk 12 years down the road.

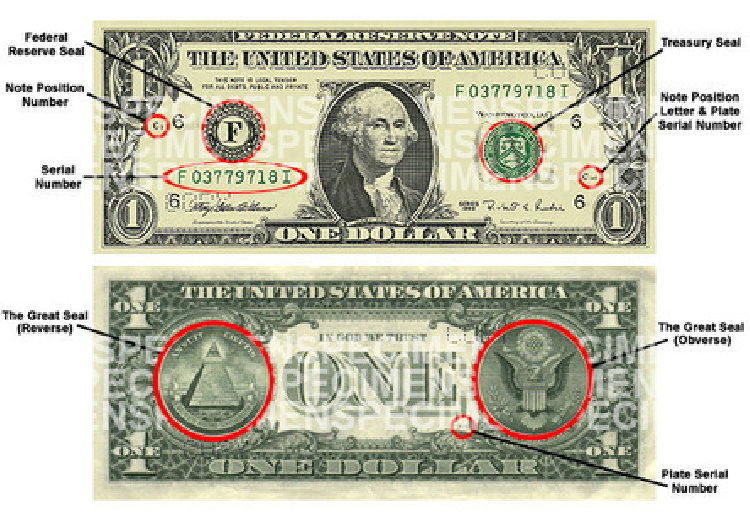

A major culprit is the Federal Reserve System. Low interest rates have fueled cheap money. Exhibit A is the housing bubble. Low interest rates keep pushing home values higher and higher, even while the intrinsic (real) value of the real estate has not changed. Runaway spending by the U.S. Congress makes matters worse. As economists say, when conditions are such that too many dollars are chasing too few goods and services, you have a clear recipe for high inflation.

Compounding the inflation problem, retirees have few opportunities to boost their incomes. Demand deposits, such as checking and savings accounts are like a snowball in hell, melting in face of inflation. Time deposits (certificates of deposit) suffer the same fate. To make matters even worse, any meager interest earned from deposits is taxed as ordinary income. After inflation and taxes levied by federal and state governments, $100.00 deposited in a bank on January 1st, will have a value (in real purchasing power) of about $94.00 on December 31.

For decades, retirees have depended on bank deposits accumulated over a lifetime to support themselves in old age. Only things have not turn out the way they planned. The United States government reduced interest rates on “savings” to near zero. Hence the old people have had to draw down on the principal in their bank deposits to survive.

As for the cost-of-living bump (Social Security) given by the government to adjust individual incomes for inflation, the COLA’s handed out may “under pay” retirees, since the formula used to determine the amount of the COLA does not measure the actual kinds of goods and services bought by retirees, which differs from goods and services purchased by others. Due to this fact retirees may fall further and further behind.

As the new year, 2022, arrives, solutions to the inflation problem get little support from policy makers. The powers that be in Washington, D.C. are ignoring the problem. This approach comes with peril for themselves and unfortunately the financial and social well-being of the American people. The familiar platitude put forth by government officials that this inflation is transitory is wrong.

If the government refuses to act, retirees and other consumers, in the face of high inflation, are likely to respond by cutting consumption voluntarily or out of necessity, even for basic things such as certain healthy foods and cleaning supplies. Such action may bring on a recession and cause inflation to slow or be brought under control.

Lifetime saving of retirees are in serious jeopardy if inflation continues. For many, if not most retirees, cutting consumption may be the only chance for long-term survival. If incomes are high enough, with an excess of income over expenses, then adding to nest eggs may save the day for some. In other words, remain whole, in a financial sense, from one year to the next.

Staying away from cash assets may be the best way for retirees to combat the current surge in inflation. That is retirees should consider dumping cash and instead turn to hard, tangible assets, such as art, farmland, and well-priced commercial real estate. Basically, anything that has, over a long period of time, proven to have a positive store of value.

Over the long run Charles Schwab, in a 2021 article, reported that stocks performed well in an inflationary environment. But the volatility of stocks may be difficult to cope with for many retirees. If a steep downturn in the market happens, years may pass before recovery.

One thing is clear, if inflation is not stopped, Americans will face very hard times in the months ahead. Retirees and low-income people will be the first victims. A great tragedy lies in store for older retirees, as they may never recover from the current and coming inflation during the remaining years of their lives. For families with few resources the guillotine that is inflation has already hit.

As for legacies, future heirs may need to recalibrate their financial planning. Inflation is a great demon, a specter not welcome by most.

Those hurt most by the surge in inflation, the poor and retirees, remain silent. They are without power and have few allies. And they are grossly uninformed about economic realities. A large swath of the middle class can be characterized in the same way.

It’s almost as if people accept the beat down caused by inflation as fate. But inflation is not as certain as sunrise and sunset. Inflation happens for a reason, particularly failure of sound management of the nation’s fiscal and monetary affairs. The government should take ownership of the problem and act to correct the inflation problem before too much damage occurs.

UPDATE 2.22.22

As of Feb. 22, 2022, the rate of inflation, year-over-year, in the United States hit 7.5%. Prices for commodities, such as oil and lumber, are accelerating. Home prices, up 18.8% in 2021, hit new ceilings almost daily. Making of a major financial crisis. Economic collapse in the United States on the horizon, if improvements in the economic picture don’t come soon.

The huge free money transfer/dump to individuals and many businesses by the United States government in the past year continues to fuel inflation. Too many dollars pushed into the economy almost overnight, chasing too few goods, could have predicted inflation. Inflation is made worse by the speed of money flowing in the economy. One individual spends dollars today and the recipient turns arounds and spends the same money again in the same day. In addition, the multiplier effect is a well know factor in economics. A real danger now of consumer expectations with a view that today’s prices will be even higher tomorrow, driving inflation to new levels.

UPDATE 2.22.2022

Alabama lawmakers respond to the financial hardship brought on by inflationary policies of the United States government. A bill in the Alabama legislature proposes a $6,000 exemption for retirees, age 65 or older, on income derived from 401k and similar accounts which are taxable income under current law. “With inflation being as high as it is today, most retirees on fixed pension incomes are seeing a substantial decrease in their purchasing power each month as inflation continues to deplete their earnings,” Alabama state Senator Arthur Orr said.

Similar legislation on the federal level is needed immediately as well. A new federal law giving individual taxpayers a $10,000 exemption on retirement income is essential to protect from high inflation caused by the government.

UPDATE 2.24.2022

The crisis is starting to look like the extreme bump in inflation that happened around 1980. From 1979 to 1982 prices rises rose about 32%. Home prices soared to record highs during those years. A cottage sold for $34,000 in Texas in 1979. In 1984, the same cottage was resold for $70,000.

UPDATE 4.14.2022 There is a solution. Go off-grid. You will have no choice, if you want to survive.

Applying the financial rule of 72, if Joe Biden’s economy continues downhill as we are experiencing now with an annual inflation rate of 8.5%, the U.S. dollar will be worth $.50 in eight (8) years. That’s right a dollar worth fifty (50 cents) and sinking.

In practical terms Americans will be forced to make do with less, a lifestyle cut in half if you will. Few retirees or poor people will be able to survive this economic wreckage.

As a practical matter, your lifestyle cannot stay the same next year as it is this year. Some real pain is immediate before collapse hits in a few years forward.